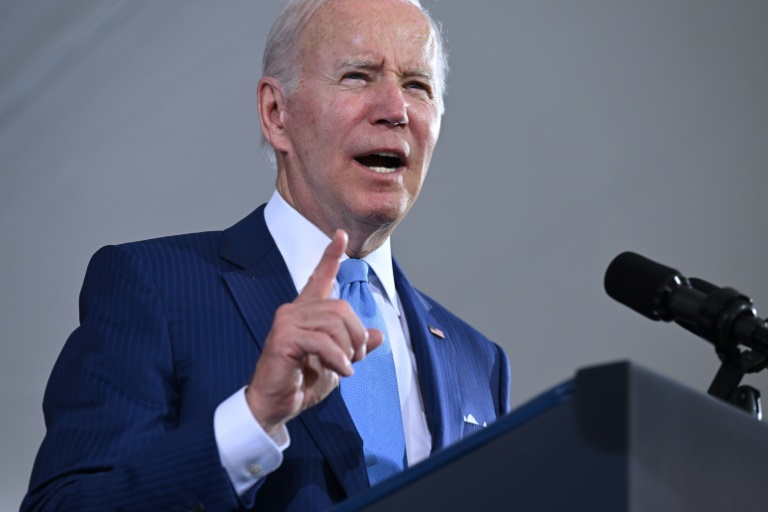

US President Joe Biden has launched a battle against soaring prices as he tries to claw back waning public support ahead of key congressional elections, but is finding he has few tools to defuse sky-high inflation.

Consumer prices have surged at the fastest pace in more than 40 years, overshadowing an otherwise strong US economy. Supply chain snarls brought on by the Covid-19 pandemic were exacerbated by Russia’s invasion of Ukraine, sending prices up as demand rapidly outstripped the supply of available goods, while a worker shortage pushes up wages.

Biden has been left scrambling for solutions as he tries to ease the pain faced by American families ahead of November midterm elections in which his Democrats are forecast to lose control of Congress to opposition Republicans.

But “there’s not much the administration can do directly to fight inflation,” Gregory Daco, chief economist at Ernst & Young Parthenon, told AFP.

Writing in the Wall Street Journal on Monday, Biden outlined his long-term plan to ease price pressures and help the world’s largest economy transition to “stable, steady growth,” by boosting economic productivity and reducing the federal budget deficit.

But the Federal Reserve, not the White House, has the primary role in tackling inflation, and has started aggressively raising interest rates to cool the economy.

Biden pledged to give the central bank the space to do its work free of political interference — unlike some of his predecessors, including Donald Trump who engaged in a relentless campaign against the Fed.

“It starts with a simple proposition: respect the Fed, respect the Fed’s independence,” he said Tuesday, following a rare meeting with Federal Reserve Chair Jerome Powell.

– ‘Limited and slow impact’ –

While employment is back near pre-pandemic levels and growth is strong, savage price increases for essentials including food and fuel have sparked growing public dissatisfaction.

Biden has pivoted to more aggressively trying to explain inflation as a byproduct of forces beyond his control, including blaming Russian leader Vladimir Putin for the invasion of Ukraine that has pushed energy and food prices higher.

Biden calls the effect “Putin’s price hike.”

But the US leader’s approval ratings are barely in the 40 percent range as people pay more at the gas pump and in the grocery store.

Gas prices on Wednesday jumped to a national average of $4.67 a gallon, from $4.19 a month ago and just $3.04 in June 2021, according to AAA.

The administration has released oil from the strategic petroleum reserve to try and bring down gas prices, but with little effect.

Other steps include clean energy tax credits and federal investments in production, as well as expanding Medicare to lower medical costs.

On Monday, Biden unveiled the Housing Supply Action Plan, which aims to improve housing supply and affordability.

But many of the contemplated steps “either require Congress to pass legislation (good luck with that) or they’re policies that won’t do a lot to bring down inflation in the near term,” said Stephanie Kelton, an economics professor at Stony Brook University, in a blog post.

Biden on Wednesday acknowledged that his power to have an immediate impact is limited.

“The idea that we’re going to be able to click a switch” to lower prices is “unrealistic,” he said.

“We can’t take immediate action” on gas prices, he said, but instead can try to “compensate” to lower costs of other goods.

– ‘I was wrong’ –

As the US economy roared back to life following the pandemic downturn, policymakers cheered but they were caught off-guard by the inflation surge.

Powell and Treasury Secretary Janet Yellen last year repeatedly assured Americans that rising prices would be “transitory,” but have since admitted they misjudged.

“I think I was wrong then about the path that inflation would take,” Yellen told CNN. “There have been unanticipated and large shocks that have boosted energy and food prices, and supply bottlenecks that have affected our economy badly.”

The Fed has begun acting aggressively to try to cool the US economy, raising the benchmark lending rate three quarters of a percentage point since March and signaling more big increases are coming in the effort to tamp down prices, hopefully without tipping the economy into recession.

Moving earlier would have helped slow the economy faster, Daco said, though at the cost of rapid growth.

But Kathy Bostjancic, a chief US economist at Oxford Economics, said the chances of a recession are low.

“We view a soft landing as the more likely outcome in 2023,” she said.

The US economy still has potential for an increase in both labor and goods, as workers return to the labor force and supply chains are restored, she said.

US consumers also are shifting spending more to services like travel an entertainment, which will take the pressure off goods.

“An increase in the supply side of the economy would go a long way to quell inflationary pressures,” Bostjancic said.

That would allow the Fed to slow rate hikes, which “could sharply improve the chances of achieving a soft-landing for the economy.”

Business5 months ago

Business5 months ago

Business4 months ago

Business4 months ago

Events6 months ago

Events6 months ago

People4 months ago

People4 months ago

Events3 months ago

Events3 months ago