Germany on Wednesday blocked the sale of two chipmakers to Chinese investors because of a potential threat to security.

“We must look very closely at company takeovers when it relates to important infrastructure or when there is a danger that the technology would flow to buyers from non-EU countries,” said Economy Minister Robert Habeck.

Chinese company Sai MicroElectronics had been seeking to buy the Dortmund factory of Elmos through its Swedish subsidiary Silex.

The German government had rejected the planned takeover because “the purchase could endanger the order and security of Germany,” said the economy ministry.

Other ways of reducing the risks, including allowing the acquisition under certain conditions, were “unable to eliminate the identified dangers”, it added.

A second acquisition had been turned down, Habeck said, without naming the companies involved because of “trade secrets”.

But Germany’s minister for research Bettina Stark-Watzinger named the company as Bavaria-based ERS Electronic, which supplies a cooling technology to wafer manufacturers.

Fears have been growing in Europe’s economic powerhouse about an over-reliance on Beijing, and letting critical infrastructure fall into the hands of Chinese state-linked companies.

Russia’s invasion of Ukraine and its subsequent dwindling of crucial gas supplies to Europe has further accentuated the concerns.

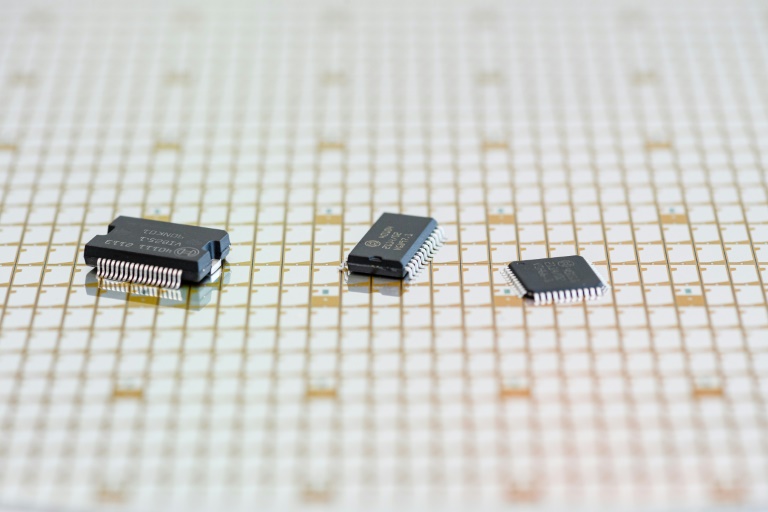

In particular, the microchip industry has come under scrutiny, as it produces key components used across industry from consumer electronics to battery-powered vehicles.

Earlier this year, the European Union unveiled a multibillion euro “Chips Act” aimed at doubling Europe’s market share in semiconductors and reducing dependence on supplies from Asia.

– ‘Not naive’ –

Elmos, which primarily builds components for the automobile industry, said late last year it intended to sell the production facility at its headquarters.

Silex was seeking to buy the site for 85 million euros ($85.4 million).

But business weekly Wirtschaftswoche said Elmos had been the recipient of 5.9 million euros from the German state for two research projects. It had also received 8.1 million euros from an EU project on autonomous driving.

Habeck said that Germany remained open to investors, but that “we are also not naive”.

Beijing has been trying to glean knowledge about production and development, underlined the minister, saying that the “statements from China are very clear”.

Habeck, of the ecologist Greens party, has recently locked horns with Chancellor Olaf Scholz over investments from China.

He deeply opposed a plan by Chinese shipping firm Cosco to buy a stake in a Hamburg port terminal, forcing Scholz to pull rank to force through the deal by allowing the purchase of a reduced stake.

Scholz has repeatedly underlined the importance of strong trade ties with Beijing, something that German industry leaders have also stressed.

China is a major market for German goods, particularly for auto giants Volkswagen, BMW and Mercedes-Benz, and many jobs in Europe’s top economy depend directly on the relationship.

On a controversial visit to Beijing last week, Scholz, accompanied by a delegation of German business bosses, told Chinese leaders that Berlin expected equal treatment on trade.

But Scholz’s trip has sparked controversy for coming so soon after Xi Jinping strengthened his hold on power in China last month.

With tensions between the West and Beijing running high on issues ranging from Taiwan to alleged human rights abuses, there had been concerns that the high-profile trip may have unsettled both the United States and the European Union.

Business4 months ago

Business4 months ago

Events6 months ago

Events6 months ago

Business4 months ago

Business4 months ago

People3 months ago

People3 months ago

Events3 months ago

Events3 months ago