Business

10 industries with the highest business survival rates

Published

1 year agoon

Top banking executives and economists are sounding the alarm: The U.S. and global economies are likely headed for a recession in 2023.

More than 1 million private companies opened between March 2021 and March 2022. But how many will survive if a recession hits? And which industries have the highest likelihood of success? Though the labor market conditions continued to improve, economists say it would be highly unusual for the U.S. job market to remain unscathed in a recession.

Using 22 years of Bureau of Labor Statistics historical data, Growthink identified the 10 industries with the highest business survival rates. About 19% of private companies founded in March 2000 were still operational by March 2022. Survival rates for all of the top 10 industries surpassed that average. Growthink determined the number of surviving companies in each industry and how many jobs the industry creates.

Keep reading to find out if you’re in an industry likely to survive a recession—and survive long-term..

![]()

Canva

#10. Manufacturing

– Survival rate since founding in March 2000: 20.7%

– Total surviving establishments: 5,086

– Total employment of survivors: 212,449 (42 employees per establishment, on average)

The manufacturing industry includes jobs associated with creating new products from raw materials or assembling components to create a new product. Workers in warehouses, factories, plants, and mills are part of the manufacturing industry. The level of education required for a career in manufacturing varies widely from one position to the next. Though machines have automated many manufacturing jobs with the advance of technology, companies will always need employees on the assembly lines to ensure smooth operations.

Canva

#9. Health care and social assistance

– Survival rate since founding in March 2000: 20.8%

– Total surviving establishments: 17,483

– Total employment of survivors: 345,809 (20 employees per establishment, on average)

This type of business includes employees of companies that provide health care, food assistance, social services, vocational rehabilitation, and child care. This industry includes hospitals, physician’s offices, medical laboratories, youth and family centers, hospice care, and elderly care homes.

Many positions in this industry are staffed by trained medical professionals with at least some higher education requirements. This is the fastest-growing sector of the U.S. job market, employing more than 18 million workers. Four in 5 health care positions are held by women.

This industry may require nontraditional work hours and expose employees to stress, patient violence, and potentially dangerous medical conditions.

Canva

#8. Educational services

– Survival rate since founding in March 2000: 21.6%

– Total surviving establishments: 1,378

– Total employment of survivors: 39,648 (29 employees per establishment, on average)

The United States is grappling with a nationwide shortage of educators. Declining college enrollment in teaching programs means the demand for employees in this sector will continue to grow. Many factors are to blame for the current staff shortage in the education industry. The politicization of curriculum, frustrations over standardized testing, soaring class sizes, low pay, and limited resources top the list of complaints by workers in the education industry.

The positive news is salaries in education are slowly rising across the country. Salaries in education vary widely depending on the position and level of experience but range from under $30,000 to over $100,000 annually.

Some of the most in-demand positions in this industry include teaching assistants, school administrators, K-12 school teachers, occupational therapists, and interpreters.

Canva

#6. Finance and insurance (tie)

– Survival rate since founding in March 2000: 21.7%

– Total surviving establishments: 8,598

– Total employment of survivors: 156,531 (18 employees per establishment, on average)

This business sector includes companies and positions involved in financial transactions or insurance services. Workers in these companies include financial managers, personal financial advisors, insurance sales agents, customer service representatives, and tellers. On average, employees in this industry work 43.4 hours weekly.

It’s one of the three highest-paying industry subsectors in the country, with an average salary of $96,211. The Bureau of Labor Statistics reports that 6.31 million people were employed in this industry in May 2021, and the numbers continue to grow yearly.

Canva

#6. Real estate and rental and leasing (tie)

– Survival rate since founding in March 2000: 21.7%

– Total surviving establishments: 5,508

– Total employment of survivors: 46,097 (8 employees per establishment, on average)

This business sector includes companies that rent, lease, and facilitate purchasing and selling tangible assets like homes or commercial properties.

During the height of the COVID-19 pandemic and the prevalence of working from home, many Americans wanted larger homes with a lower cost of living. In attempts to socially distance in the search for the perfect home, virtual home viewings and real-estate closings saw a sharp rise during the pandemic.

There are over 3 million active real estate agents and over 106,000 active real estate brokerage firms in the United States. The average salary of workers in this industry was $54,330 in 2021, an increase from $43,330 in 2020.

Canva

#5. Accommodation and food services

– Survival rate since founding in March 2000: 23.9%

– Total surviving establishments: 10,957

– Total employment of survivors: 279,795 (26 employees per establishment, on average)

Workers in this industry provide food and lodging for immediate consumption by consumers. They include people employed at hotels, motels, fast-food restaurants, casinos, RV parks, dining establishments, catering services, bed and breakfasts, and more.

As the U.S. economy has grown over the last five years, so has the accommodation and food services industry. When Americans have disposable income, the frequency with which they travel and dine out rises. Many restaurants and hotels struggled to find employees during the pandemic, resulting in higher wages and sign-on bonuses for many workers.

The market size of this sector was forecast to reach $1.41 trillion in 2022, up from $1.05 trillion in 2021.

Canva

#4. Retail trade

– Survival rate since founding in March 2000: 27.0%

– Total surviving establishments: 21,562

– Total employment of survivors: 483,930 (22 employees per establishment, on average)

Retail is the final step of the supply chain in distributing merchandise to the general public; this includes traditional brick-and-mortar stores, direct sales, and the ever-expanding e-commerce market.

Retail sales have steadily increased in the United States since 2009. In 2019, there were 442,597 brick-and-mortar retail stores and 2.1 million e-commerce retailers in the United States. A few job titles in the retail sector include pharmacist, warehouse manager, web designer, head butcher, stockroom worker, and customer service representative.

Wages vary widely depending on the position, but as of May 2021, the median hourly pay for a retail sales position was $14.

Canva

#3. Agriculture, forestry, fishing, and hunting

– Survival rate since founding in March 2000: 27.2%

– Total surviving establishments: 1,573

– Total employment of survivors: 34,965 (22 employees per establishment, on average)

This sector includes workers who grow crops, raise animals, harvest timber, and catch fish, whether from a farm or controlled setting or in the wild. Many jobs in this industry require on-site training versus time spent in a classroom. In fact, about 1 in 4 workers in this industry do not have a high school diploma. Self-employed positions, like farming and fishing, account for almost 40% of the workforce in this sector. And more than 3 in 4 companies in this sector employ fewer than 10 workers.

Canva

#2. Utilities

– Survival rate since founding in March 2000: 33.3%

– Total surviving establishments: 290

– Total employment of survivors: 8,799 (30 employees per establishment, on average)

The utility sector includes companies that provide basic everyday needs like water, garbage collection, electricity, and natural gas. Utilities are always in demand, so the industry doesn’t typically suffer during a recession. More than 4 in 5 of the United State’s energy infrastructure is owned by private companies, which are typically heavily regulated by government agencies.

Many positions in this industry require a college degree or advanced technical education. Many of the highest-paid positions in this industry are in various engineering roles. Global demand for renewable and sustainable energy continues to create new positions within the utility industry.

Canva

#1. Management of companies and enterprises

– Survival rate since founding in March 2000: 35.3%

– Total surviving establishments: 915

– Total employment of survivors: 52,787 (58 employees per establishment, on average)

The sector with the most businesses that have lasted since 2000 is one that consists of establishments that run other companies that they own or are under contract to manage. Unlike industries categorized by their field of work such as manufacturing or leisure, the management of companies and enterprises industry is one that the Bureau of Labor Statistics differentiates because of their role—this sector manages other enterprises and may not only have a single-store or single-location business within any one field. This is noteworthy because this factors into the typical size of these management companies: This sector accounts for the largest employment rates per company. There are an average of 57.7 employees per surviving business in this industry compared to 12.4 employees at a construction company or 8.4 employees at a real estate company.

As of May 2021, there were 2.3 million people employed in these businesses, in jobs like financial managers, accountants, auditors, bookkeepers, chief executives, and lawyers. The highest-paid positions in this industry are in securities commodities and financial services sales. The industry is projected to have a job growth of 5.4% over 10 years.

This story originally appeared on Growthink and was produced and

distributed in partnership with Stacker Studio.

Founded in 2017, Stacker combines data analysis with rich editorial context, drawing on authoritative sources and subject matter experts to drive storytelling.

You may like

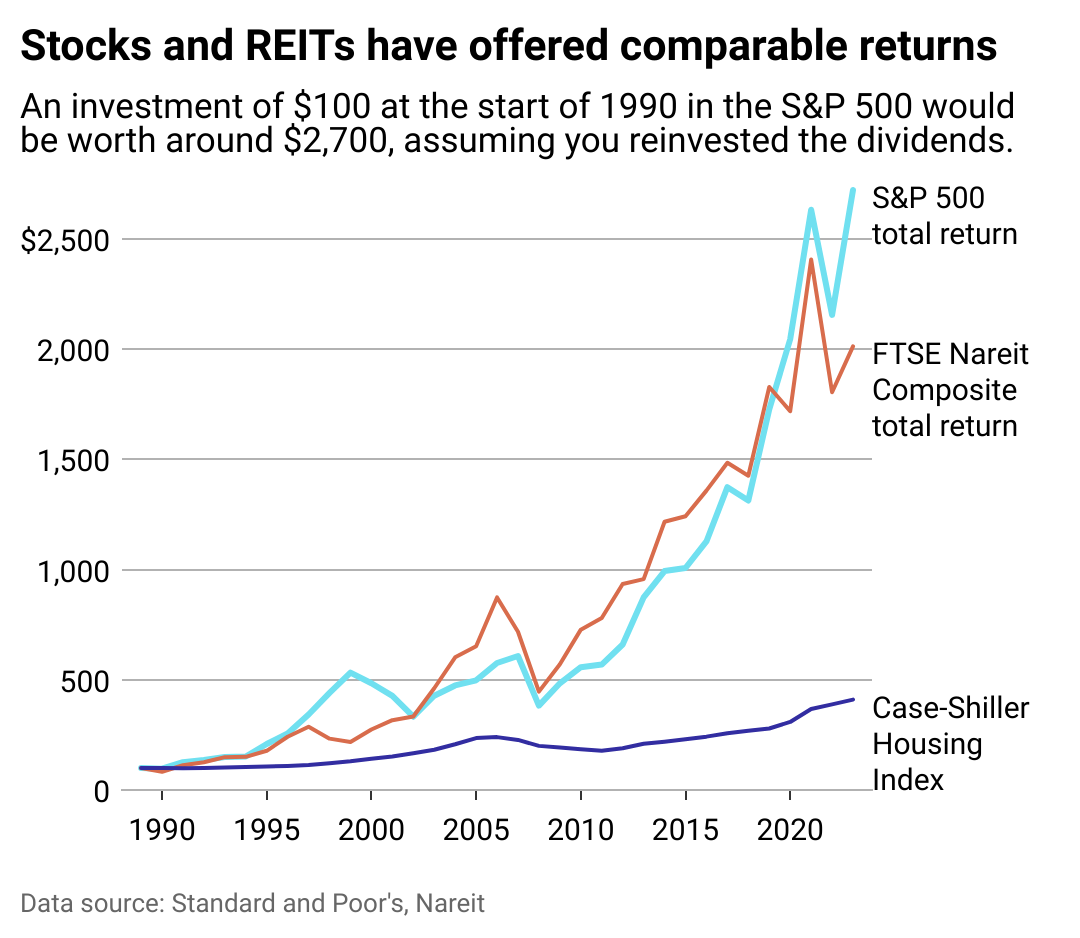

It’s well-documented that the surest, and often best, return on investments comes from playing the long game. But between stocks and real estate, which is the stronger bet?

To find out, financial planning firm Wealth Enhancement Group analyzed data from academic research, Standard and Poor’s, and Nareit to see how real estate compares to stocks as an investment.

Data going back to 1870 shows the well-established power of real estate as a powerful “long-run investment.” From 1870-2015, and after adjusting for inflation, real estate produced an average annual return of 7.05%, compared to 6.89% for equities. These findings, published in the 2019 issue of The Quarterly Journal of Economics, illustrate that stocks can deviate as much as 22% from their average, while housing only spreads out 10%. That’s because despite having comparable returns, stocks are inherently more volatile due to following the whims of the business cycle.

Real estate has inherent benefits, from unlocking cash flow and offering tax breaks to building equity and protecting investors from inflation. Investments here also help to diversify a portfolio, whether via physical properties or a real estate investment trust. Investors can track markets with standard resources that include the S&P CoreLogic Case-Shiller Home Price Indices, which tracks residential real estate prices; the Nareit U.S. Real Estate Index, which gathers data on the real estate investment trust, or REIT, industry; and the S&P 500, which tracks the stocks of 500 of the largest companies in the U.S.

High interest rates and a competitive market dampened the flurry of real-estate investments made in the last four years. The rise in interest rates equates to a bigger borrowing cost for investors, which can spell big reductions in profit margins. That, combined with the risk of high vacancies, difficult tenants, or hidden structural problems, can make real estate investing a less attractive option—especially for first-time investors.

Keep reading to learn more about whether real estate is a good investment today and how it stacks up against the stock market.

![]()

Wealth Enhancement Group

Stocks and housing have both done well

REITs can offer investors the stability of real estate returns without bidding wars or hefty down payments. A hybrid model of stocks and real estate, REITs allow the average person to invest in businesses that finance or own income-generating properties.

REITs delivered slightly better returns than the S&P 500 over the past 20-, 25-, and 50-year blocks. However, in the short term—the last 10 years, for instance—stocks outperformed REITs with a 12% return versus 9.5%, according to data compiled by The Motley Fool investor publication.

Whether a new normal is emerging that stocks will continue to offer higher REITs remains to be seen.

This year, the S&P 500 reached an all-time high, courtesy of investor enthusiasm in speculative tech such as artificial intelligence. However, just seven tech companies, dubbed “The Magnificent 7,” are responsible for an outsized amount of the S&P’s returns last year, creating worry that there may be a tech bubble.

While indexes keep a pulse on investment performance, they don’t always tell the whole story. The Case-Shiller Index only measures housing prices, for example, which leaves out rental income (profit) or maintenance costs (loss) when calculating the return on residential real estate investment.

Wealth Enhancement Group

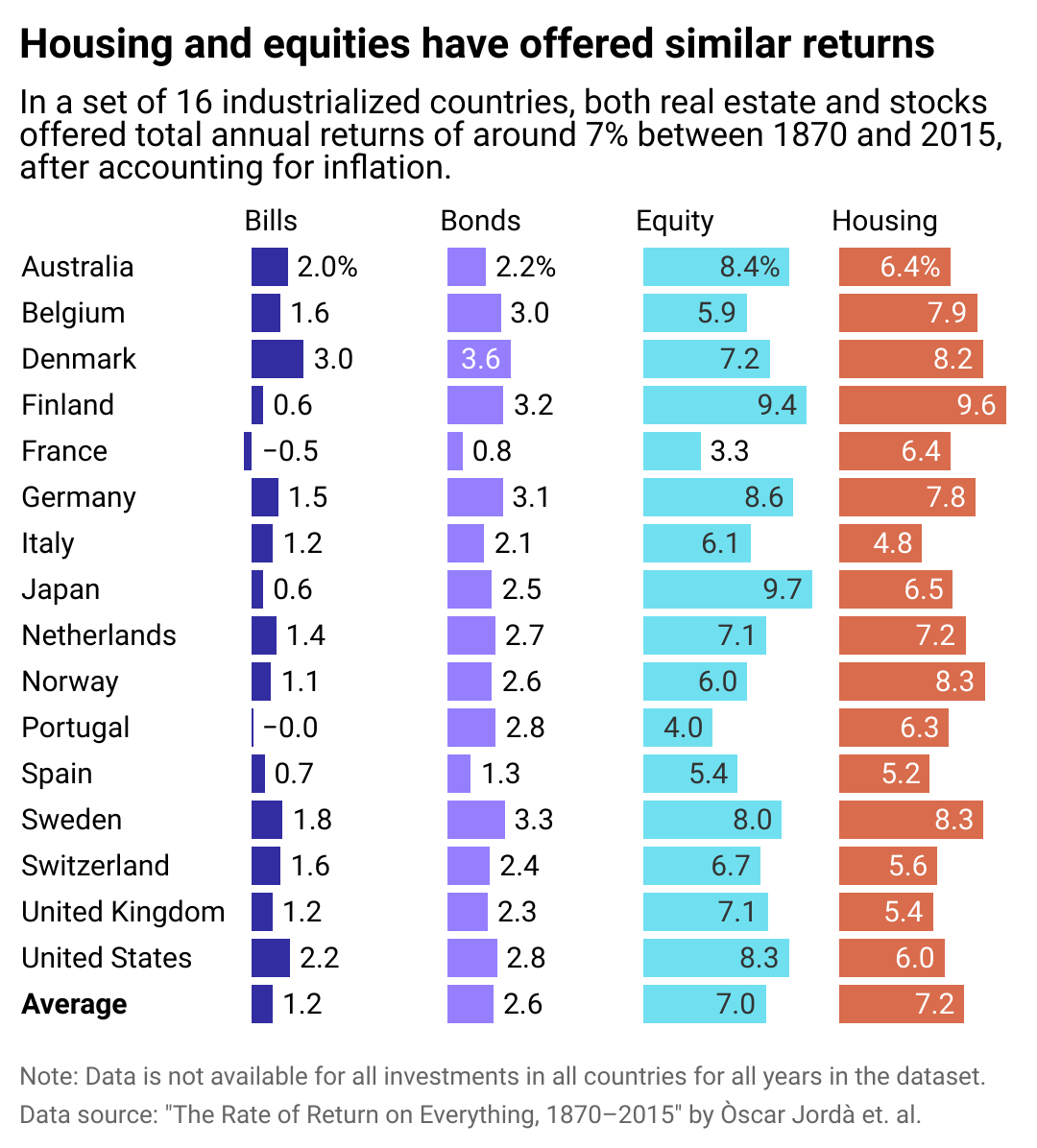

Housing returns have been strong globally too

Like its American peers, the global real estate market in industrialized nations offers comparable returns to the international stock market.

Over the long term, returns on stocks in industrialized nations is 7%, including dividends, and 7.2% in global real estate, including rental income some investors receive from properties. Investing internationally may have more risk for American buyers, who are less likely to know local rules and regulations in foreign countries; however, global markets may offer opportunities for a higher return. For instance, Portugal’s real estate market is booming due to international visitors deciding to move there for a better quality of life. Portugal’s housing offers a 6.3% return in the long term, versus only 4.3% for its stock market.

For those with deep enough pockets to stay in, investing in housing will almost always bear out as long as the buyer has enough equity to manage unforeseen expenses and wait out vacancies or slumps in the market. Real estate promises to appreciate over the long term, offers an opportunity to collect rent for income, and allows investors to leverage borrowed capital to increase additional returns on investment.

Above all, though, the diversification of assets is the surest way to guarantee a strong return on investments. Spreading investments across different assets increases potential returns and mitigates risk.

Story editing by Nicole Caldwell. Copy editing by Paris Close. Photo selection by Lacy Kerrick.

This story originally appeared on Wealth Enhancement Group and was produced and

distributed in partnership with Stacker Studio.

Founded in 2017, Stacker combines data analysis with rich editorial context, drawing on authoritative sources and subject matter experts to drive storytelling.

Business

5 tech advancements sports venues have added since your last event

Published

1 week agoon

April 19, 2024

In today’s digital climate, consuming sports has never been easier. Thanks to a plethora of streaming sites, alternative broadcasts, and advancements to home entertainment systems, the average fan has myriad options to watch and learn about their favorite teams at the touch of a button—all without ever having to leave the couch.

As a result, more and more sports venues have committed to improving and modernizing their facilities and fan experiences to compete with at-home audiences. Consider using mobile ticketing and parking passes, self-service kiosks for entry and ordering food, enhanced video boards, and jumbotrons that supply data analytics and high-definition replays. These innovations and upgrades are meant to draw more revenue and attract various sponsored partners. They also deliver unique and convenient in-person experiences that rival and outmatch traditional ways of enjoying games.

In Los Angeles, the Rams and Chargers’ SoFi Stadium has become the gold standard for football venues. It’s an architectural wonder with closer views, enhanced hospitality, and a translucent roof that cools the stadium’s internal temperature.

The Texas Rangers’ ballpark, Globe Life Field, added field-level suites and lounges that resemble the look and feel of a sports bar. Meanwhile, the Los Angeles Clippers are building a new arena (in addition to retail space, team offices, and an outdoor public plaza) that will seat 18,000 people and feature a fan section called The Wall, which will regulate attire and rooting interest.

It’s no longer acceptable to operate with old-school facilities and technology. Just look at Commanders Field (formerly FedExField), home of the Washington Commanders, which has faced criticism for its faulty barriers, leaking ceilings, poor food options, and long lines. Understandably, the team has been attempting to find a new location to build a state-of-the-art stadium and keep up with the demand for high-end amenities.

As more organizations audit their stadiums and arenas and keep up with technological innovations, Uniqode compiled a list of the latest tech advancements to coax—and keep—fans inside venues.

![]()

Jeff Gritchen/MediaNews Group/Orange County Register // Getty Images

Just Walk Out technology

After successfully installing its first cashierless grocery store in 2020, Amazon has continued to put its tracking technology into practice.

In 2023, the Seahawks incorporated Just Walk Out technology at various merchandise stores throughout Lumen Field, allowing fans to purchase items with a swipe and scan of their palms.

The radio-frequency identification system, which involves overhead cameras and computer vision, is a substitute for cashiers and eliminates long lines.

RFID is now found in a handful of stadiums and arenas nationwide. These stores have already curbed checkout wait times, eliminated theft, and freed up workers to assist shoppers, according to Jon Jenkins, vice president of Just Walk Out tech.

Billie Weiss/Boston Red Sox // Getty Images

Self-serve kiosks

In the same vein as Amazon’s self-scanning technology, self-serve kiosks have become a more integrated part of professional stadiums and arenas over the last few years. Some of these function as top-tier vending machines with canned beers and nonalcoholic drinks, shuffling lines quicker with virtual bartenders capable of spinning cocktails and mixed drinks.

The kiosks extend past beverages, as many college and professional venues have started using them to scan printed and digital tickets for more efficient entrance. It’s an effort to cut down lines and limit the more tedious aspects of in-person attendance, and it’s led various competing kiosk brands to provide their specific conveniences.

Kyle Rivas // Getty Images

Mobile ordering

Is there anything worse than navigating the concourse for food and alcohol and subsequently missing a go-ahead home run, clutch double play, or diving catch?

Within the last few years, more stadiums have eliminated those worries thanks to contactless mobile ordering. Fans can select food and drink items online on their phones to be delivered right to their seats. Nearly half of consumers said mobile app ordering would influence them to make more restaurant purchases, according to a 2020 study at PYMNTS. Another study showed a 22% increase in order size.

Many venues, including Yankee Stadium, have taken notice and now offer personalized deliveries in certain sections and established mobile order pick-up zones throughout the ballpark.

Darrian Traynor // Getty Images

QR codes at seats

Need to remember a player’s name? Want to look up an opponent’s statistics at halftime? The team at Digital Seat Media has you covered.

Thus far, the company has added seat tags to more than 50 venues—including two NFL stadiums—with QR codes to promote more engagement with the product on the field. After scanning the code, fans can access augmented reality features, look up rosters and scores, participate in sponsorship integrations, and answer fan polls on the mobile platform.

Boris Streubel/Getty Images for DFL // Getty Images

Real-time data analytics and generative AI

As more venues look to reinvigorate the in-stadium experience, some have started using generative artificial intelligence and real-time data analytics. Though not used widely yet, generative AI tools can create new content—text, imagery, or music—in conjunction with the game, providing updates, instant replays, and location-based dining suggestions

Last year, the Masters golf tournament even began including AI score projections in its mobile app. Real-time data is streamlining various stadium pitfalls, allowing operation managers to monitor staffing issues at busy food spots, adjust parking flows, and alert custodians to dirty or damaged bathrooms. The data also helps with security measures. Open up an app at a venue like the Honda Center in Anaheim, California, and report safety issues or belligerent fans to help better target disruptions and preserve an enjoyable experience.

Story editing by Nicole Caldwell. Copy editing by Paris Close. Photo selection by Lacy Kerrick.

This story originally appeared on Uniqode and was produced and

distributed in partnership with Stacker Studio.

Founded in 2017, Stacker combines data analysis with rich editorial context, drawing on authoritative sources and subject matter experts to drive storytelling.

Business

Import costs in these industries are keeping prices high

Published

2 weeks agoon

April 11, 2024

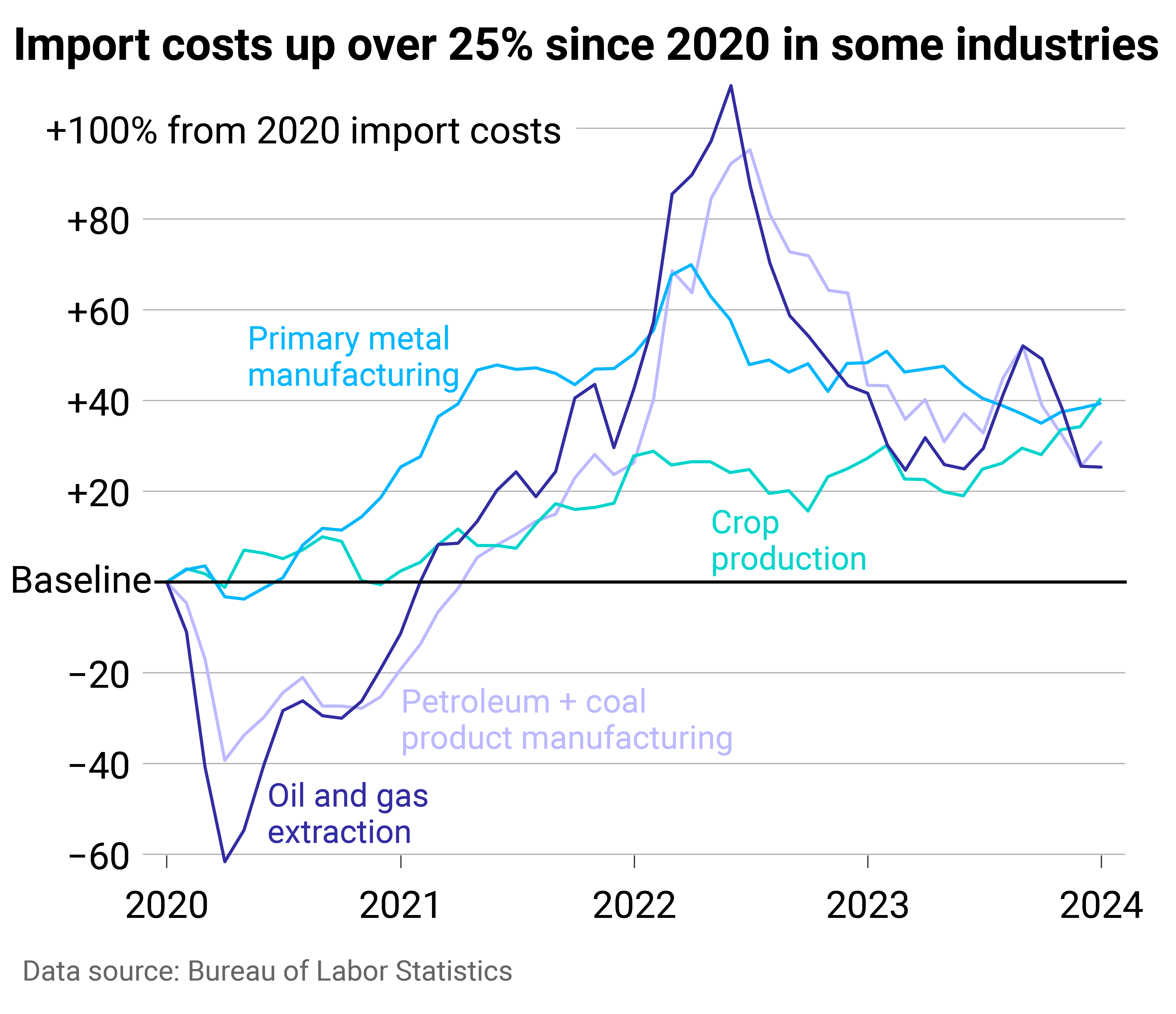

Inflation has cooled substantially, but Americans are still feeling the strain of sky-high prices. Consumers have to spend more on the same products, from the grocery store to the gas pump, than ever before.

Increased import costs are part of the problem. The U.S. is the largest goods importer in the world, bringing in $3.2 trillion in 2022. Import costs rose dramatically in 2021 and 2022 due to shipping constraints, world events, and other supply chain interruptions and cost pressures. At the June 2022 peak, import costs for all commodities were up 18.6% compared to January 2020.

While import costs have since fallen most months—helping to lower inflation—they remain nearly 12% above what they were in 2020. And beginning in 2024, import costs began to rise again, with January seeing the highest one-month increase since March 2022.

Machinery Partner used Bureau of Labor Statistics data to identify the soaring import costs that have translated to higher costs for Americans. Imports in a few industries have had an outsized impact, helping drive some of the overall spikes. Crop production, primary metal manufacturing, petroleum and coal product manufacturing, and oil and gas extraction were the worst offenders, with costs for each industry remaining at least 20% above 2020.

![]()

Machinery Partner

Imports related to crops, oil, and metals are keeping costs up

At the mid-2022 peak, import costs related to oil, gas, petroleum, and coal products had the highest increases, doubling their pre-pandemic costs. Oil prices went up globally as leaders anticipated supply disruptions from the conflict in Ukraine. The U.S. and other allied countries put limits on Russian revenues from oil sales through a price cap of oil, gas, and coal from the country, which was enacted in 2022.

This activity around the world’s second-largest oil producer pushed prices up throughout the market and intensified fluctuations in crude oil prices. Previously, the U.S. had imported hundreds of thousands of oil barrels from Russia per day, making the country a leading source of U.S. oil. In turn, the ban affected costs in the U.S. beyond what occurred in the global economy.

Americans felt this at the pump—with gasoline prices surging 60% for consumers year-over-year in June 2022 and remaining elevated to this day—but also throughout the economy, as the entire supply chain has dealt with higher gas, oil, and coal prices.

Some of the pressure from petroleum and oil has shifted to new industries: crop production and primary metal manufacturing. In each of these sectors, import costs in January were up about 40% from 2020.

Primary metal manufacturing experienced record import price growth in 2021, which continued into early 2022. The subsequent monthly and yearly drops have not been substantial enough to bring costs down to pre-COVID levels. Bureau of Labor Statistics reporting shows that increasing alumina and aluminum production prices had the most significant influence on primary metal import prices. Aluminum is widely used in consumer products, from cars and parts to canned beverages, which in turn inflated rapidly.

Aluminum was in short supply in early 2022 after high energy costs—i.e., gas—led to production cuts in Europe, driving aluminum prices to a 13-year high. The U.S. also imposes tariffs on aluminum imports, which were implemented in 2018 to cut down on overcapacity and promote U.S. aluminum production. Suppliers, including Canada, Mexico, and European Union countries, have exemptions, but the tax still adds cost to imports.

U.S. agricultural imports have expanded in recent decades, with most products coming from Canada, Mexico, the EU, and South America. Common agricultural imports include fruits and vegetables—especially those that are tropical or out-of-season—as well as nuts, coffee, spices, and beverages. Turmoil with Russia was again a large contributor to cost increases in agricultural trade, alongside extreme weather events and disruptions in the supply chain. Americans felt these price hikes directly at the grocery store.

The U.S. imports significantly more than it exports, and added costs to those imports are felt far beyond its ports. If import prices continue to rise, overall inflation would likely follow, pushing already high prices even further for American consumers.

Story editing by Shannon Luders-Manuel. Copy editing by Kristen Wegrzyn.

This story originally appeared on Machinery Partner and was produced and

distributed in partnership with Stacker Studio.

Founded in 2017, Stacker combines data analysis with rich editorial context, drawing on authoritative sources and subject matter experts to drive storytelling.

Featured

-

Business5 months ago

Business5 months agomesh conference goes deep on AI, with experts focusing in on training, ethics, and risk

-

Business4 months ago

Business4 months agoSkill-based hiring is the answer to labour shortages, BCG report finds

-

People4 months ago

People4 months agoHow connected technologies trim rework and boost worker safety in hands-on industries

-

Events6 months ago

Events6 months agoTop 5 tech and digital transformation events to wrap up 2023

-

Events3 months ago

Events3 months agoThe Northern Lights Technology & Innovation Forum comes to Calgary next month